Te damos la bienvenida a la comunidad de impacto social más grande del mundo. ¡Únete!

Sé parte

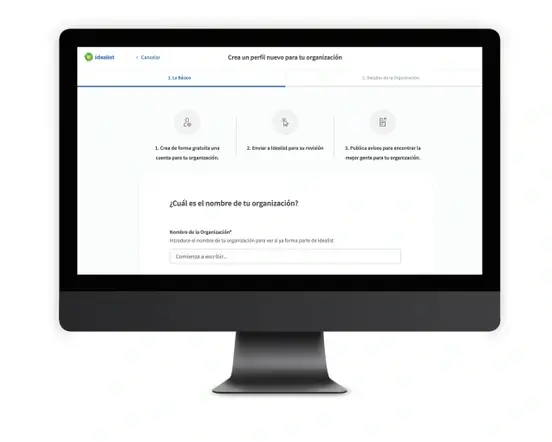

Visibiliza el trabajo que haces registrando tu organización

¿Tienes un proyecto, organización sin fin de lucro, eres empresa social, agencia de gobierno o consultor trabajando para el tercer sector? Sé parte de la mayor red de impacto del mundo. Regístrate ahora y publica oportunidades de voluntariado, empleo, eventos...

Encuentra tu oportunidad para ser parte del cambio

Idealist ayuda a conectar causas con personas que buscan oportunidades para pasar a la acción alrededor del mundo. Visita nuestro Mapa de Acción, o revisa aquí algunas opciones para comenzar...

Inspírate en nuestro BLOG

Con historias de personas que transforman el mundo en positivo, eventos, convocatorias y mucho más.

Encuentra OPORTUNIDADES

Encuentra organizaciones con las que colaborar/trabajar a través de oportunidades de empleo, voluntariado, eventos, etc. cerca de ti o en remoto.

Identifica RECURSOS

Conecta con herramientas para convertirte en un agente de cambio en nuestro Centro de Recursos para la Acción Social

Sobre Nosotros

Idealist es una organización sin fines de lucro con sede en Nueva York y representantes para español y portugués en Ecuador, España y Brazil. Juntos, queremos construir un mundo donde todos podamos vivir libre y dignamente. Comenzamos con esta misión en 1995, amamos lo que hacemos y estamos aquí para lo que necesites.